Few green shoots emerge across the region

By Joshua Ohl

CoStar Analytics

October 13, 2025 | 11:41 AM

Recent months have done little to change San Diego’s office narrative. The vacancy rate has climbed unabated to over 13% at the end of the third quarter, marking the highest level since 2011. While the national vacancy rate is roughly 100 basis points higher than San Diego’s, the year-over-year change to vacancy was eight times greater in San Diego.

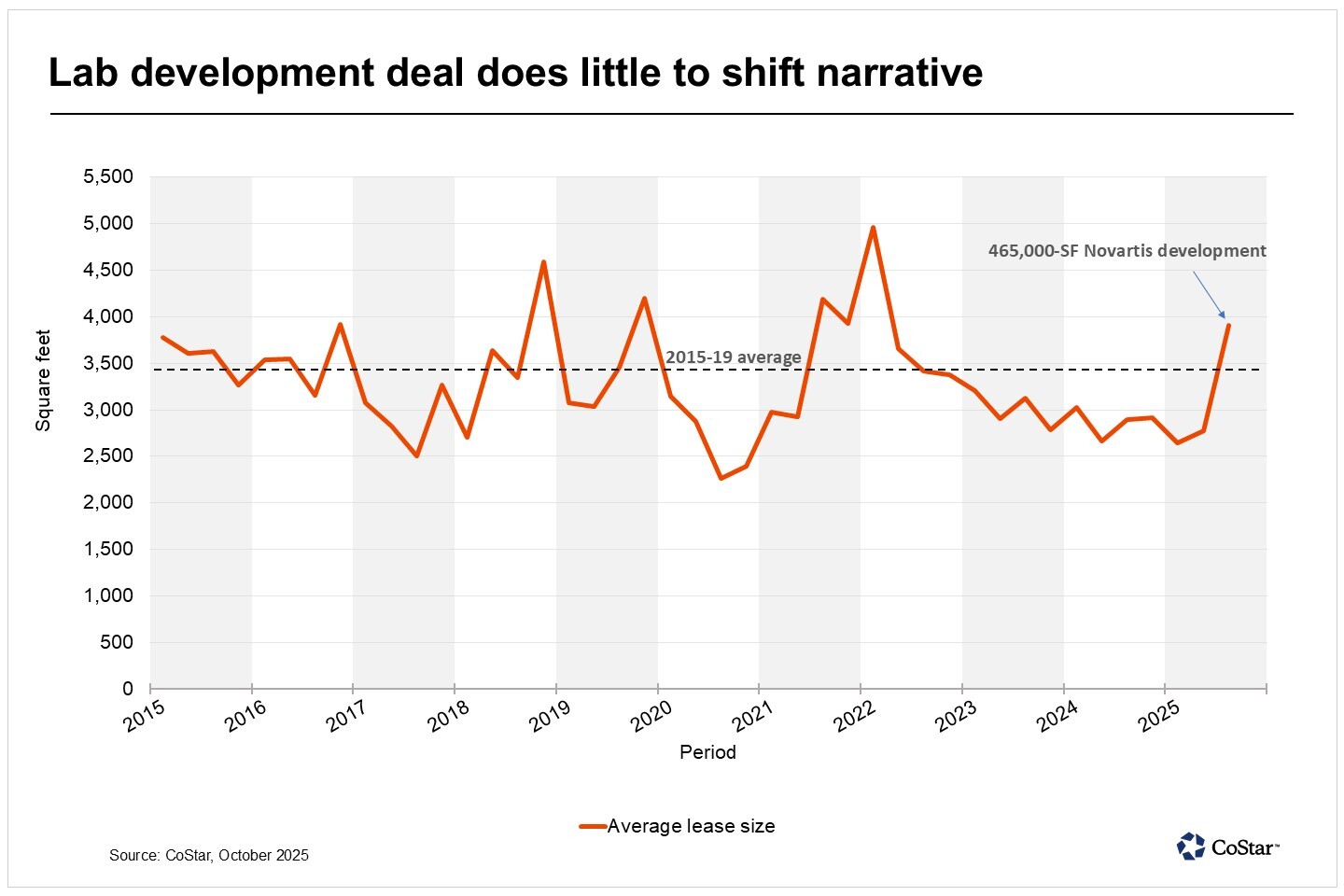

While leasing volume rose 40% quarter over quarter to its highest level in over two years, it was not indicative of the demand environment thawing. Instead, it was driven by a 465,000-square-foot development deal for Novartis to build a lab project in UTC.

Leasing volume has settled 15% to 20% below the trend during the last cycle between 2015 and 2019, and the number of lease transactions has fallen a similar amount.

On the whole, market participants generally do not think that the leasing environment will reverse course anytime soon. San Diego has never been a corporate headquarters town, which can stifle the upside to demand, and there have been few large requirements that might materially shift the narrative.

Smaller lease transactions below 5,000 square feet have accounted for almost 50% of leasing volume in 2025, and nearly 75% of transactions were less than 10,000 square feet. During the last cycle, leases below 10,000 square feet accounted for under 60% of leasing volume.

San Diego’s construction pipeline has largely been shut off since early this year, when the RaDD development was completed along the Embarcadero downtown. That 1.7 million-square-foot lab and office project has leased only one space to a lab user and has become more open to finding traditional office tenants.

The Campus at Horton, a sprawling million-square-foot mixed-use project downtown, has been in a state of near-completion for over a year. The property was returned to its lender this summer, and its status has become uncertain. It has been changed from under construction to deferred, according to CoStar research, until its timeline becomes more concrete. While that will delay vacancy rising even further in the downtown area due to its completion without office tenants, downtown San Diego’s office vacancy rate has already risen above 35%, the highest level this century.

With firms continuing to shrink their footprints coupled with slower office-using job growth — it was negative during the past four quarters — vacancy is expected to continue rising and may approach 14% by the end of next year.

(Posted with permission by Costar)