The trajectory follows the overall industrial market

By Joshua Ohl via CoStar

CoStar Analytics

It has been nearly three years since occupancy increased quarter over quarter in San Diego’s industrial market.

Vacancy climbed to 9.5% at the end of the third quarter, which was the highest level since 2012. That marked a 250 basis-point increase year over year after roughly 3.6 million square feet of space was delivered coupled with nearly 2.2 million square feet of negative absorption, which tracks the change in occupancy over time.

The momentum from early 2025, when leasing volume reached a two-year high, was short-lived due to the broader uncertainty surrounding the imposition of tariffs that has spread since the spring.

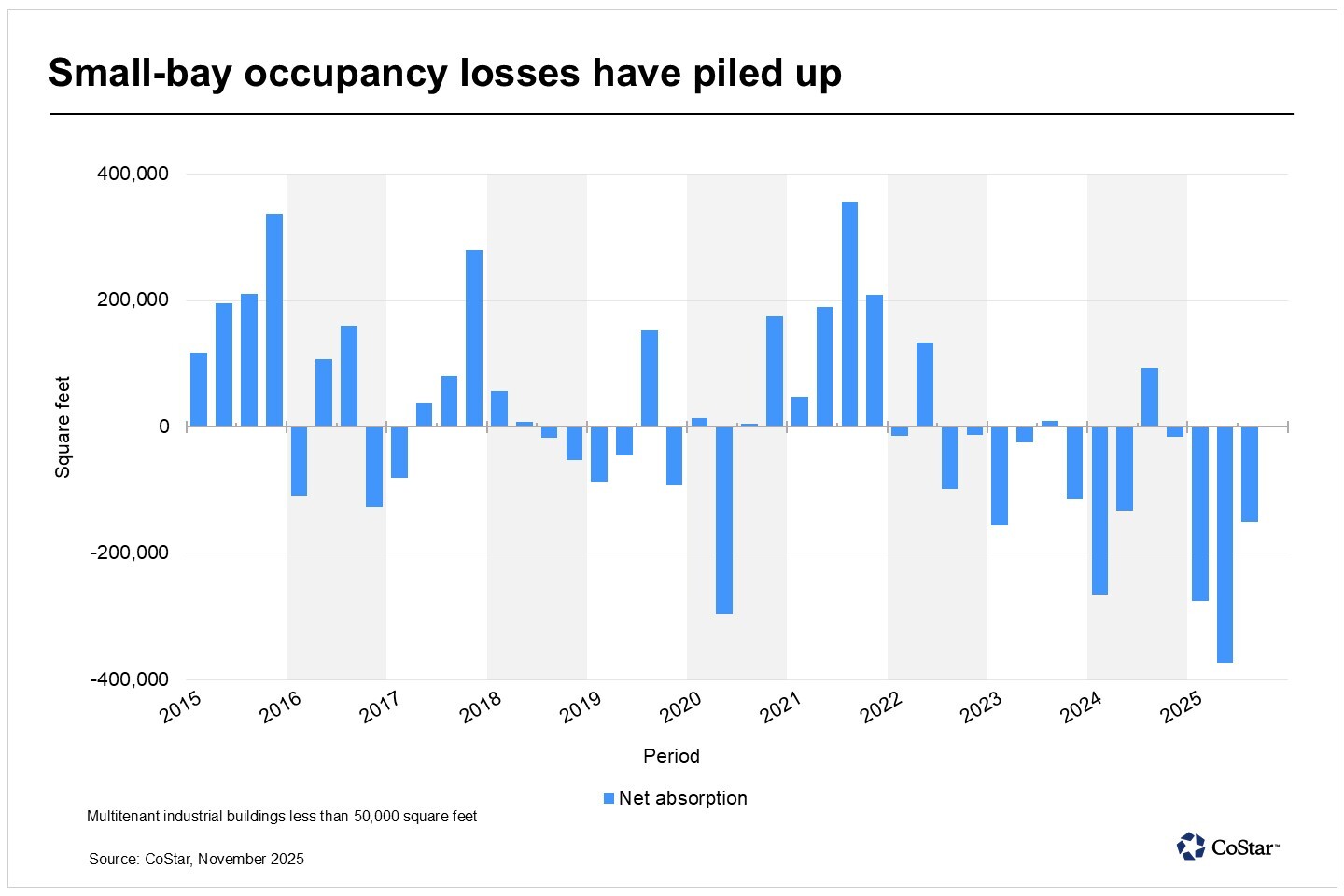

Small-bay, multitenant properties under 50,000 square feet have not been able to sidestep the broader retrenchment in demand. Vacancy has increased 200 basis points year over year to 5.7%, following 800,000 square feet of negative absorption in the past four quarters and no new supply across the county.

One of San Diego’s primary small-bay nodes has been in North County, along State Route 78 from Oceanside and Carlsbad through Vista, Escondido and San Marcos. More than one-third of San Diego’s multitenant small-bay inventory is here.

Over 250,000 people are employed along that economic corridor, which has been a catalyst for economic growth in the region. Action sports, defense, tourism, manufacturing and life sciences are among the leading industries here, with many small-bay occupiers working in those fields.

However, vacancy has followed the broader regional trend, rising 250 basis points year over year to 5.4%, while recording only one quarter of positive absorption in the past two years.

North County landlords have been more proactive with tenants on expiring leases in recent quarters. Flexible lease terms on renewals, often shorter than a standard three-year renewal, while keeping rents flat, have been used to keep these spaces filled. Landlords who have held out for longer terms on renewals or more rent growth have often experienced more turnover.

North County brokers have reported that the transaction period has nearly doubled, having previously run closer to 30 to 60 days, and an extra month free has become more common with new leases.

Small-bay landlords have little supply-side pressure to worry about in North County or across the rest of the San Diego region. Only 5% of the construction pipeline involves small-bay properties, and they total less than 100,000 square feet.

But that will do little to improve the sentiment among North County landlords who have seen demand weaken and available units sit empty. It has not been uncommon for tenants nearing the finish line in a lease negotiation to pull out due to broader economic uncertainty and concerns over insurance and utility expenses. Few market participants expect a material shift in demand in the early stages of 2026.

Reposted with permission from CoStar