Rate of personal savings falls to three-year low

By Christine Cooper, Chuck McShane

CoStar Analytics

January 28, 2026 | 7:08 AM

Consumers maintained robust spending in late 2025, according to new Bureau of Economic Analysis data released last week that had been delayed by the federal government shutdown.

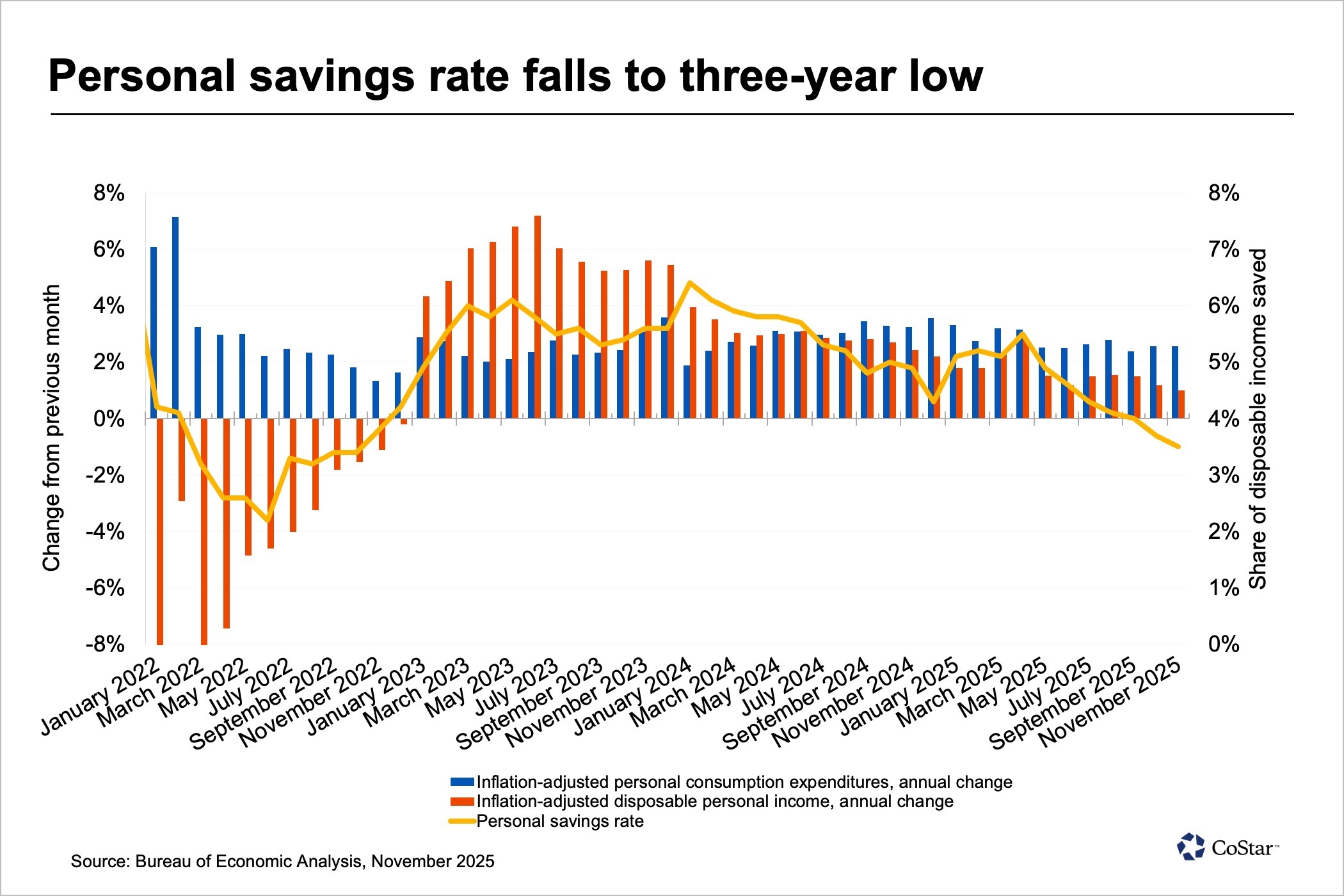

However, shoppers increasingly dipped into savings accounts to get through the holiday season, reducing the personal savings rate to a three-year low. And with year-over-year real spending growth outpacing disposable income growth for the 17th consecutive month, this spending growth appears to be on an unsustainable path.

Still, economists expect consumer spending growth to continue in 2026. Those projections for positive, albeit slower, spending growth hinge on new tax policies delivering higher-than-average annual tax refunds in the first quarter. Combined with provisions of the One Big Beautiful Bill Act, these changes are expected to bring incomes and costs into better balance.

For now, delayed data from October and November show inflation-adjusted consumer expenditures rose by 0.3% each month. On an annual basis, real consumption expenditures were up 2.6%. That was significantly higher than real personal disposable income growth, which slowed to 1% in November, the lowest growth rate since December 2022.

As a result, the personal savings rate has fallen to 3.5%, its lowest level since October 2022, and down more than 2 percentage points since a recent peak in April 2025.

The savings rate is now on-par with the 2022 inflationary spiral, when rapidly rising prices led to 12 consecutive months of inflation-adjusted income declines. Personal savings reached a bottom of 2.2% in June 2022 before stabilizing at more typical levels between 5% and 6% through 2023 and 2024 as inflation cooled.

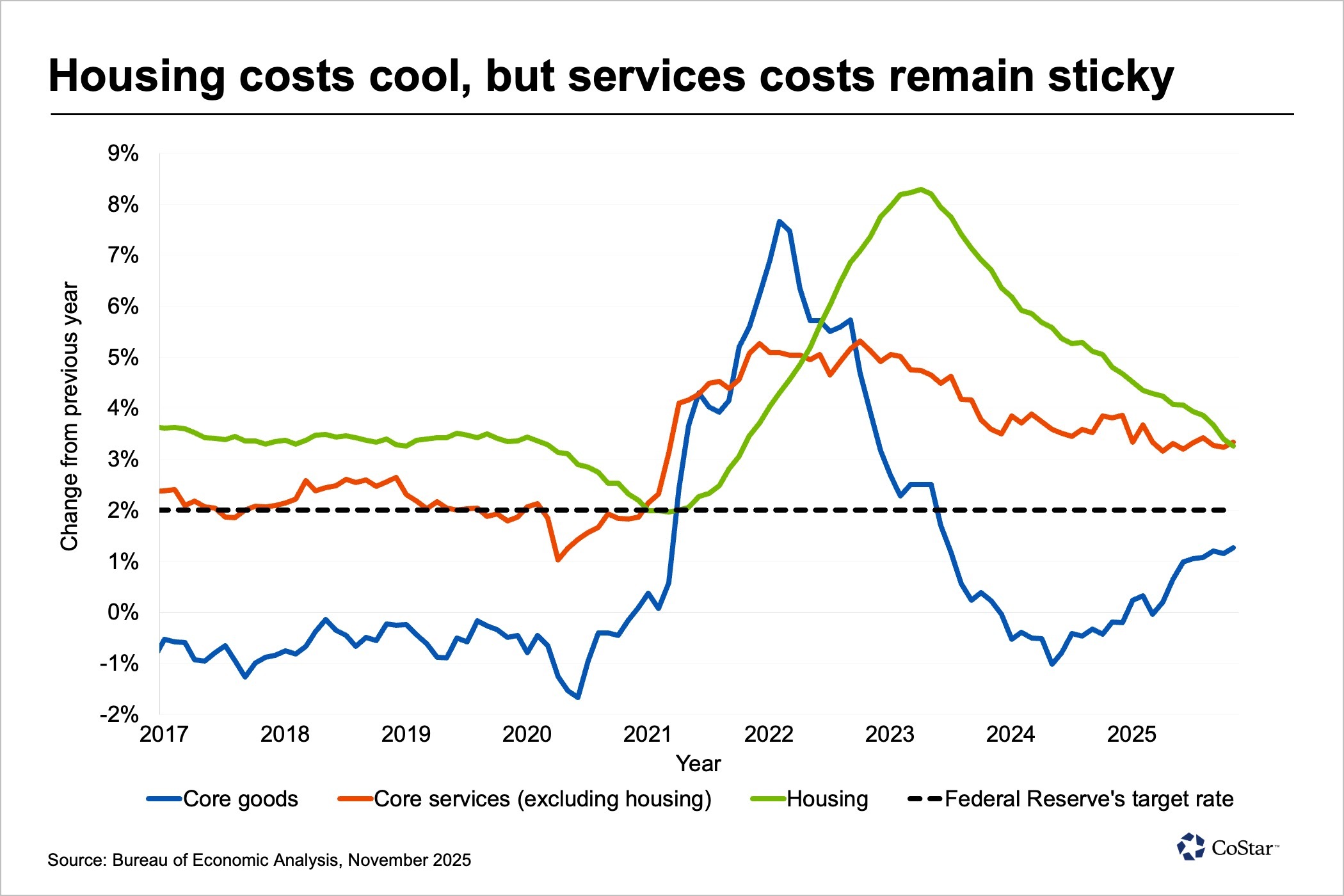

More recently, the pace of that cooling has stagnated. Personal Consumption Expenditures inflation, measuring price changes for consumer goods and services, and Core PCE inflation, which excludes volatile food and energy categories, were both up 2.8% on an annual basis in November. Core PCE, the Federal Reserve’s preferred measure of inflation, has hovered between 2.6% and 3% for two years.

Though the headline inflation rate has stagnated, the sources of those price increases have shifted. Annual services inflation has been stuck between 3.2% and 3.4% since March 2025, and goods prices have reaccelerated from disinflation in 2024 to a 1.3% annual pace of price growth through November 2025, with larger increases among many tariff-impacted categories.

Housing inflation, on the other hand, has consistently cooled, falling to 3.3% in November 2025 from 4.8% in November 2024. These trends set the stage for continued cooling of housing inflation through 2026, keeping a ceiling on overall inflation.

The PCE housing index tends to lag rent changes by nine to 12 months. Apartment asking rents were up just 0.4% in the fourth quarter of 2025, according to CoStar data, down from a 1.2% growth rate in 2024.

Income growth, not inflation, will likely be the more pressing concern for sustaining consumer spending through 2026. Inflation-adjusted annual income growth fell to 1% in November, down from a recent peak of 2.8% in April 2025.

Though wealth concentration among higher-income consumers has kept overall spending robust, with the top 20% of income earners responsible for the bulk of consumer spending, the recent erosion of the savings rate means that stabilizing disposable income growth will become increasingly important for the bottom 80% who have minimal financial reserves.

One source of potential income growth is expected to come through larger tax refunds as new provisions of the One Big Beautiful Bill Act are realized. The Tax Foundation estimates the cumulative impact of the slew of new or increased deductions could exceed $100 billion. That could increase taxpayer refunds, which have averaged about $3,000 over the past two years, by an additional $300 to $1,000.

Tax refunds should boost consumer spending in the first few months of 2026. Ultimately, though, job market growth will be necessary to sustain spending.

What we’re watching …

Unfortunately, it’s becoming more difficult to find work in today’s labor market if you’re on the hunt for a job, according to recent data.

The Conference Board’s consumer confidence index for January came in at 84.5, down from 94.2 in December and its lowest level since mid-2014. All five of its component indices worsened, including the job market assessment, with the share of respondents who think jobs are “plentiful” minus the share who say jobs are “hard to find” continuing to fall.

Not promising news for those still on the sidelines.

CoStar Economy is produced this week by Christine Cooper, CoStar’s managing director and chief U.S. economist, and Chuck McShane, senior director of market analytics.

Reposted with permission from CoStar